News

Budget with the 50/30/20 Rule!

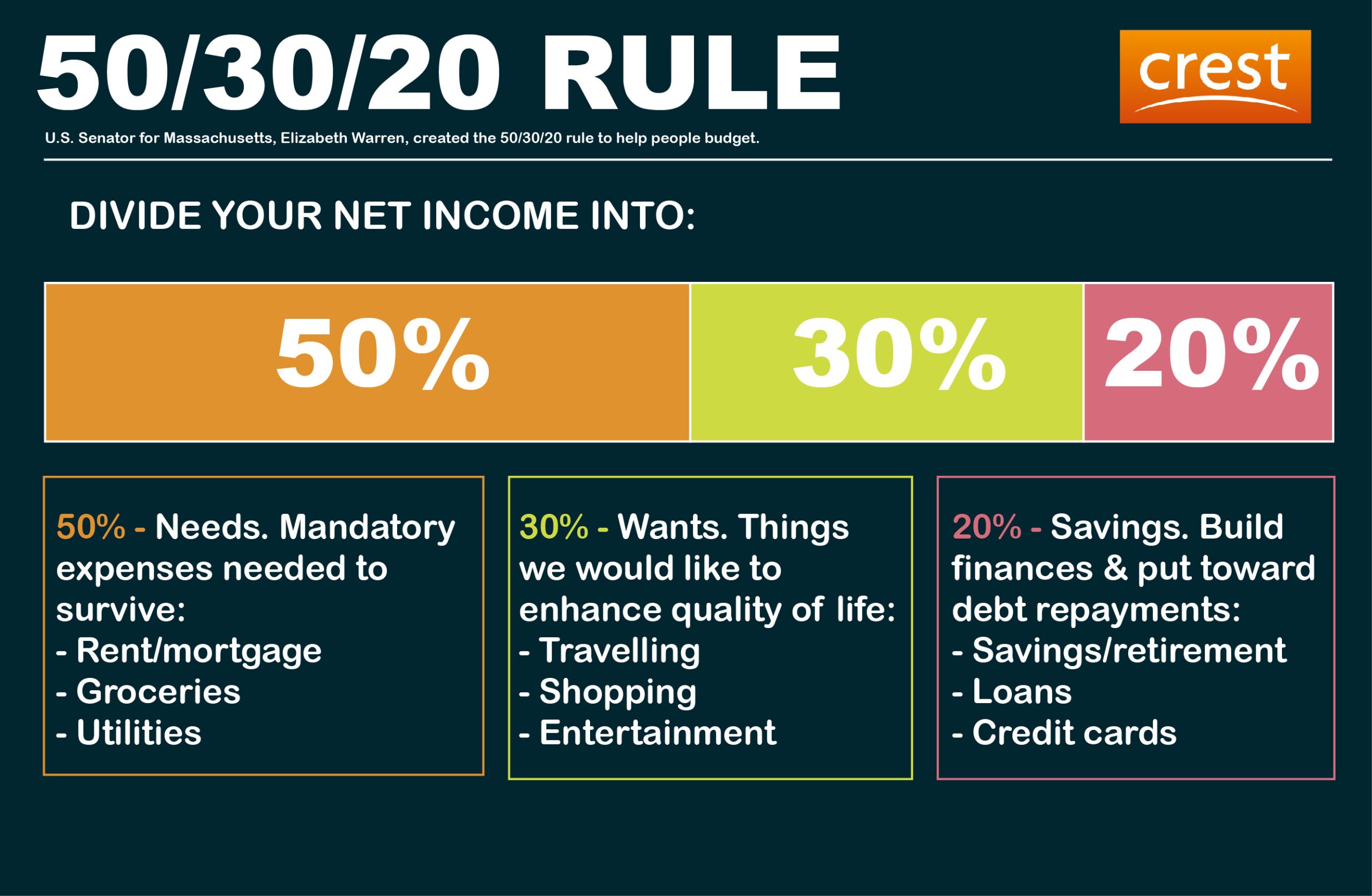

Some people find budgeting to be a difficult task with determining how much of their income to put aside for their expenses and to pay off debt. To make budgeting easier, try using Elizabeth Warren, U.S. Senator for Massachusetts, 50/30/20 rule to be a guideline for budgeting. The rule works with the net income of an individual and splits this into three categories; Needs, Wants and Savings.

How to apply this to your situation?

Example: John is creating his budget and has determined what his expenses are. Using the 50/30/20 rule, he has split these into three categories.

Needs: Groceries, utilities, fuel, mortgage

Wants: Travel, internet shopping, dining out

Savings: Investments, Super (reducing bad debts etc).

John has a net income of $80,000 ($1538.46 per week). For his budget he determines the weekly amount using the 50/30/20 rule. For his Needs, he allocates 50% of his net income. The weekly amount he can spend is $769.23 for expenses such as groceries, utilities, fuel and mortgages. 30% or $461 is then allocated towards Wants and the remaining 20% ($307.69), are for Savings. This remainder will be the amount allocated to build finances and to put toward debt repayments. Once debt is paid off – this then gets allocated to accumulating investments.

Need assistance? Contact our helpful team at Crest Accounting.